Help Station

Upload your

documents

If you need to send us proof of your No Claims Bonus, copy of driving licence or insurance documents, you can either email to us or upload online.

How to send your Driving Licence Summary

This document provides details on how to send us your Driving licence Summary if we have requeted it.

How to send proof of your No Claims Bonus

This document provides information on how to send us proof of No Claims Bonus if we have requested it.

FAQ's - Your questions answered

We’ve put together some commonly asked questions to give you more information about the insurance cover we offer. If you can’t find what you’re looking for, call us on 0330 127 4500 and we’ll be happy to help.

In each section, click on a question to reveal the answer.

Driving licence summary

When you take out motor insurance with A Choice, we may ask you to provide your driving licence summary or create a licence ‘check code’. Visit the DVLA website for instructions on how to view or share your driving licence information.

You can upload your driving licence summary via our secure upload portal, or by email

Alternatively, you can post your Driving Licence Summary to the following address:

A ChoicePendeford House

Pendeford Business Park

Overstrand

Wolverhampton

WV9 5AP

You’ll need to send this to us within 14 days of purchase.

What you will need

- Your driving licence number

- Your national insurance number

- The postcode on your driving licence

To view or share your driving licence information

- Visit the DVLA website.

- Click the green ‘Start now’ button.

- Submit your driving licence number, national insurance number and postcode. Then tick the ‘I agree’ box and click ‘View Now’.

- Select the ‘Get Your Check Code’ option and then click on the green ‘Get a Code’ tab.

- Once you have the code, click on the ‘Print or save a driving summary’ link.

- Now select the ‘Open’ tab option and your summary will be generated.

- Save the PDF record and then email, upload or post the driving record to us. Ensure you include your reference number.

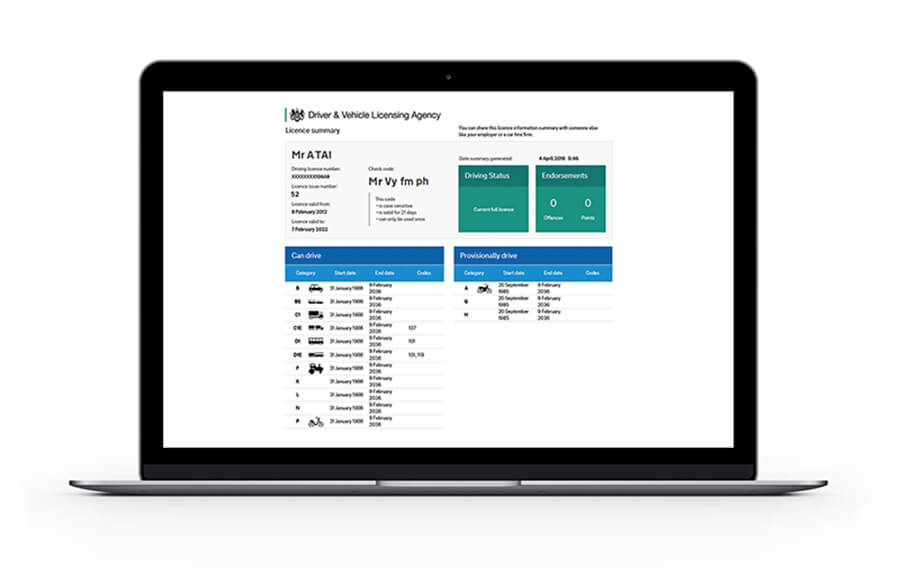

Below is an acceptable example of a Driving Licence Summary generated on the DVLA website.

Important Information

- All named drivers will be required to complete this process.

- If you do not have access to the internet, you must contact the DVLA on 0300 790 6801 to obtain a check code.

- Check codes are valid for 21 days, so must be submitted within this time to enable us to confirm your record.

No Claims Bonus (NCB)

We’ll let you know if we need you to provide valid proof of No Claims Bonus. See our helpful guide which helps to explain what is acceptable proof of No Claims Bonus and how to send it to us.

You can upload your proof of No Claims Bonus via our secure upload portal, or you can email it to us if you prefer.

Alternatively, you can post your proof of No Claims Bonus to the following address:

A ChoicePendeford House

Pendeford Business Park

Overstrand

Wolverhampton

WV9 5AP

You’ll need to send this to us within 14 days of purchase.

What you will need

Your proof of No Claims Bonus should be in the form of your latest renewal notice or evidence of your last cancelled or lapsed car insurance policy. If there is any gap in cover you need to make us aware, as this may make a difference to the cover we can offer you.

To share your proof of No Claims Bonus

It is quick and easy to send us your details digitally:

- Take pictures of your documents using a smartphone, tablet or digital camera

- Scan your documents using a desktop scanner

- You can then upload the images via our secure portal or email over to us

- Alternatively, you can post a copy or scan your documents

You’ll need to send us your full name and reference number in any communication.

Once we’ve received your proof we’ll then contact you to confirm it is acceptable or let you know if we need any more information.

If you don’t have written proof of No Claims Bonus (NCB), you can do the following.

You can contact your previous insurer directly and ask them to send you proof of NCB. Please see our helpful guide for more information.

Your proof of No Claims Bonus needs to include the following:

- Be on official company headed paper

- In the name of the policy holder

- Vehicle registration number

- Number of years of NCB entitlement

- Policy date/expiry date

- Past 5 years claim history (if applicable)

Alternatively, to help save you some time you can email us with your policy reference number in the subject line. Send us your previous insurance company name, previous insurance policy number, vehicle registration number and your previous address if you have moved within the last 2 years; and we will try to obtain the proof of NCB for you.

If your previous insurer was Admiral, Adrian Flux/Flux Direct, Bell, Diamond, Elephant, General Accident, More Than Smart Wheels, Octagon, Quote Me Happy, Tesco or Tesco Bank, you will have to contact the insurer as they will need to speak to you directly.

Car insurance renewal

You can renew your insurance policy from 30 days before your renewal date.

We will send you a reminder with your renewal details before your policy expires, which will explain what you need to do to renew your insurance.

If you have purchased your policy via Direct Debit method, we may automatically renew your cover for your convenience. We will tell you if this is the case in your renewal reminder.

You can contact our Renewals team on 0330 127 4500 and select option 2, where a member of our dedicated team will be happy to help.

If you have purchased your policy via Direct Debit method, at renewal we may offer to renew it for you automatically. This provides you peace of mind that you don’t end up driving uninsured.

We will inform you if this is the case in your renewal reminder, which you will receive from us before your policy expires.

If you paid for your policy in full last year, we will not automatically renew your policy. We will send you a reminder with your renewal details before your policy expires, which will explain what you need to do to renew your insurance.

If you have any questions about your renewal or you would like to opt out of the automatic renewal, please call our Renewals team on 0330 127 4500, select option 2. Alternatively, you can email [email protected].

Charges may apply if you call us to cancel your policy after the new policy has started. For more information, refer to section 11 of our Terms of Business Agreement.

Once we’ve arranged your insurance cover and processed your policy documents, you have a 14-day cooling off period where you can cancel your policy.

If you wish to cancel your policy, then you will need to contact our Customer Services team on 0330 127 4500 and select option 4. Subject to the cancellation terms of your policy, a refund of premium may be available. We aim to process all refunds within 30 days of receipt of notice of cancellation.

For more information, see our Terms of Business Agreement.

As an insurance broker, we compare car insurance quotes from around 20 different insurers to find you a competitive rate based on your needs. We work hard to ensure that our prices are amongst the most competitive in the market.

When comparing car insurance, it is important that you don’t compromise on the quality of coverage and service in case you need to make a claim.

But, if you do find cheaper car insurance elsewhere, please give us a call and we’ll see if we can match or better the other insurer’s price.

Here are some benefits of renewing your policy with A Choice:

✔ Free dedicated claims line open 24 hours a day, 7 days a week, 365 days a year to offer you protection when you need it the most.

✔ Friendly UK based call centre to help you answer your queries.

✔ Instant answers to your questions from our comprehensive online FAQs.

✔ Flexible payment options available to suit your needs.

✔ Choice of excesses allowing you to tailor your cover.

✔ Wide range of optional extras available so you can shape your policy.

Call our Renewals team on 0330 127 4500 and select option 2 (Mon-Fri: 8 am to 5 pm, Sat: 9 am to 1 pm) where a member of our dedicated team will be happy to help.

Changing your car insurance details

As a broker we work hard to get you a tailored policy that fits your demands and needs. To ensure your policy continues to do this for you, when you need to make a change, we just ask our customers to give us a call so we can provide you with your options.

To make a change to your car insurance with A Choice, call our Adjustments team on 0330 127 4500 and select option 3. Our opening hours are:

| Monday to Friday: | 8am – 5pm |

| Saturday: | 9am – 1pm |

Once you have told us about any changes, we will update your car insurance policy and if necessary, make any adjustments to your premium. There may be an amendment fee for processing this change, for further information please see the Terms of Business Agreement.

It is important that you let us know about any changes in your circumstances, as some of these changes may affect your insurance premium. If you are not sure, it is always best to double check with us.

Failure to make us aware of these changes may invalidate your insurance policy. You may also face a fine from the DVLA if you fail to make them aware of any changes to your personal details.

Here are some examples of the types of changes you will need to tell us about:

- If you are changing your vehicle

- Change of address or where the vehicle is kept overnight

- If you or a named driver changes occupation

- If you would like to add an additional driver to your insurance policy

- Your annual mileage has changed

- If you have any driving convictions

Yes, if you make any vehicle modifications, including changes to:

- Engine

- Suspension

- Brakes

- Body

- Exhaust

- Wheels

It’s important we are aware of any changes, so we can ensure you are correctly covered by your insurer in the event of a claim. Certain modifications can affect your insurance premium.

This is not an exhaustive list and if you’re unsure, call our Adjustments team on 0330 127 4500 and select option 3. Our opening hours are:

| Monday to Friday: | 8am – 5pm |

| Saturday: | 9am – 1pm |

About my car insurance policy

Our aim is to get your insurance documents to you as soon as possible. We encourage our customers to receive them electronically which helps to save paper, save trees and helps our environment!

Your documents will be emailed to you by the end of the next working day. Please ensure you have provided us with the correct email address. Also remember to check your spam or junk folder.

However, if you prefer, we can send your documents to you by post. Please allow up to 7 working days for your documentation to arrive. If you have not received your documents, please contact our Customer Services team on 0330 127 4500 and select option 4.

Once you have received your insurance documents, please take the time to read through the information carefully. If anything is missing or incorrect, please let us know immediately as this could result in a claim not being paid.

Don’t assume that you are covered to drive someone else’s car. If you’re found to be driving someone else’s car when your insurance doesn’t cover you, you could face points on your licence.

Check your policy certificate and read this in conjunction with your policy booklet to see if this cover is included. Alternatively, you can call our Customer Service team on 0330 127 4500 and select option 4 for advice. Our opening hours are:

| Monday to Friday: | 8am – 5pm |

| Saturday: | 9am – 1pm |

If your insurance policy allows you to drive other cars – Cover is limited to Third Party Only. The policy holder may only drive other private motor cars not owned by themselves or hired to them under a rental, hire purchase or lease agreement. Restrictions may apply. Refer to policy documents for full details

When you insure your car, you need to tell your insurer what you will be using it for, so you can make sure you’re correctly covered in the event of a claim. Below are some examples for the different levels for class of use:

Social, domestic and pleasure (SDP)

This covers normal day-to-day driving such as shopping, visiting friends and going on day trips. It doesn’t include cover for commuting to a place of work, or anything to do with employment or business.

Social, domestic, pleasure and commuting (SDP+C)

In addition to providing cover for Social, Domestic and Pleasure purposes, cover is also provided for the policyholder driving to and from one permanent place of work or study.

This also provides cover if you use the vehicle for part of the journey, for example driving to the train station as part of your onward journey to work.

Business Class 1

Provides cover for driving in connection with their business or that of their employer, to multiple places of work. This is for the policyholder or spouse named on the policy.

Use in connection with commercial travelling, hire and reward and motor trade are excluded.

Business Class 2

Same as Business Class 1, but also provides cover for the named driver for travelling to different places of work for the business of the policyholder. For example, a small business owned by the policyholder where the vehicle is driven by an employee.

Use in connection with commercial travelling, hire and reward and motor trade are excluded.

Business Class 3

Customers who use the vehicle for commercial purposes such as door to door sales, or for delivering parcels. Unfortunately, our policies do not offer cover for this class of use.

Adding business use could affect the premium as generally you’ll be driving more miles, during in busy periods and potentially on unfamiliar roads.

If you are unsure whether you need to add business use or not, give our Adjustments team a call on 0330 127 4500 and select option 3.

Hire and Reward

This allows the vehicle to be used for carrying other people, or goods in return for payment.

Hire and reward is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee.

If you wish to cancel your policy, then you will need to contact our Customer Services team on 0330 127 4500 and select option 4. Our opening hours are:

| Monday to Friday: | 8am – 5pm |

| Saturday: | 9am – 1pm |

Alternatively, please complete the online Cancellation Request Form.

For more information, see our Terms of Business Agreement.

One option is to pay for your insurance in full by debit or credit card. We don’t charge you any fees for payment by credit or debit card. Please note we do not accept American Express.

Alternatively, you could pay your insurance by Direct Debit through our third-party finance provider. This means you may pay a deposit (if applicable) and pay the rest over monthly instalments.

If you select to pay by instalments, it’s important that you are comfortable you can meet the number and cost of your monthly payments. Paying by instalments will be more expensive compared to paying in full. Other finance options may be available with other providers at a lower cost.

Some learner drivers feel more comfortable practising their driving skills in their own car rather than someone else’s. You can take your driving test in your own car providing it meets certain rules. For more information, see Driving test in your own car.

Once you pass your test, you must contact us straight away so we can update your policy, otherwise you won’t be insured to drive the vehicle home from the test centre.

A Choice opening hours

Sales

If you are a new customer looking to get a car insurance quote, discuss a previous quote, or take out an insurance policy, call our Sales team on 0330 127 4500 and select option 1.

| Monday to Friday: | 9am – 5pm |

| Saturday: | 9am – 1pm |

Renewals

If you have recently received your renewal invitation letter and would like to discuss your policy, call our Renewals team on 0330 127 4500 and select option 2.

| Monday to Friday: | 8am – 5pm |

| Saturday: | 9am – 1pm |

Adjustments

To make changes to your existing insurance policy, call our Adjustments team on 0330 127 4500 and select option 3.

| Monday to Friday: | 8am – 5pm |

| Saturday: | 9am – 1pm |

Customer Service

For any other queries about your policy, call our Customer Service team on 0330 127 4500 and select option 4.

| Monday to Friday: | 8am – 5pm |

| Saturday: | 9am – 1pm |